- Certified phone accessories store

- 0616818330

- info@fulloriginal.nl

What’s No-Earnings Confirmation Mortgage? Will they be Nevertheless readily available?

- Home

- payday cash advance no credit check

- What’s No-Earnings Confirmation Mortgage? Will they be Nevertheless readily available?

If you don’t have grand deals by which you can aquire an excellent home during the cash, that you might have to endure the procedure of mortgage verification.

Now, the entire process of financial confirmation is not usually a lengthy one to but are a boring you to. Although some borrowers want to obtain regarding old-fashioned lending organizations particularly banking institutions, a few of all of them choose the personal money lenders.

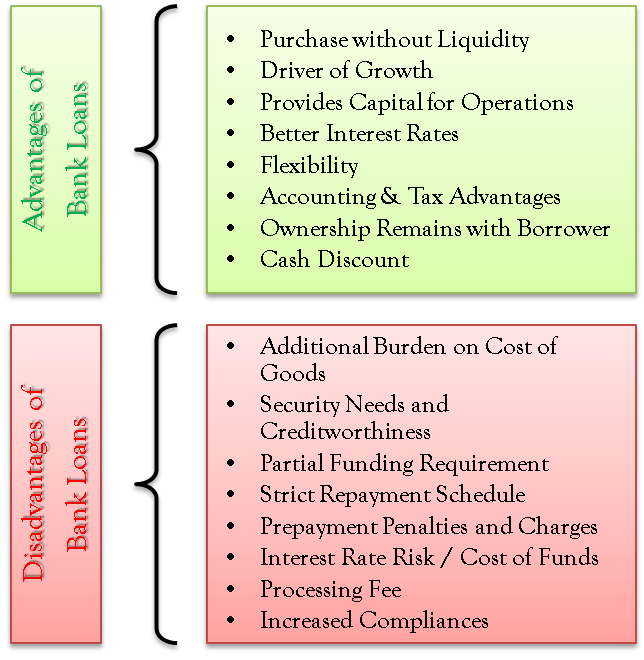

Each other solutions has actually their benefits and drawbacks as well as the final decision should be produced according to the particular financing you would like which you have today.

So if you’re a self-functioning elite group whose income varies per month, being qualified to own a home loan is harder for your requirements as compared to remainder of the parcel.

And therefore results in thinking about the most readily useful financing choice you to are offered for people who do not draw otherwise make repaired income each month. It was problematic additionally the commercial real estate financing industry did assembled a solution.

The difficulty?

After you normally apply for financing, banking companies and personal money loan providers essentially need you to promote facts of cash.

This is accomplished to verify you are deciding to make the money punctually. Sounds somewhat fair. Check out documents that will be basically would have to be delivered while you sign up for verified financing:

- Money stubs regarding history 30-45 weeks

- W-dos kinds of history a couple of years

- Lender statements of the past a couple of years

- Taxation statements of one’s last couple of years

This means that, for folks who failed to make certain your revenue of the submitting the aforementioned-said data, it would have been hard on the best way to secure a loan.

That was the major state as there is actually an increasing people off mind-functioning experts, freelancers while others whoever earnings models are not usually repaired, such as for example an individual who would depend greatly to the income gained because of inventory markets trade, an such like.

Therefore the biggest matter is actually just because they did not have a good consistent’ income move each month, don’t suggest they can’t afford to pay back its financing loans Bridgeport AL obligations and that must not come into the way of its domestic to purchase fantasies.

So, the clear answer?

The answer to this problem away from being unable to safe a loan on account of unstable or contradictory money activities try Zero-Earnings Confirmation financing.

Also known as industrial said money fund, it was considered as a benefit to everyone off real home there decided not to feel one happy news that the inclusion regarding no-money confirmation financing into mind-working borrowers.

This web site is an overview from the these finance, as to the reasons they were a giant triumph just for some time, what resulted in their refuse finally, is industrial mentioned money financing nonetheless available?

Just what are Zero-Earnings Verification finance?

No-Earnings Confirmation finance was a kind of home loan that doesn’t want the latest debtor add the newest proof of income or any kind regarding files of money. They’re also named by the a couple of other brands No Doc mortgages and you will Stated money mortgages.

Put in effortless words, said income mortgages was mortgage loans that will be offered toward foundation of earnings which is stated by the borrowers instead carrying out one verification of these income stated.

These kind of funds instantaneously kicked of really well and it turned into to-be called as a benefit to the world out-of a home, particularly for notice-employed consumers.

That was a time when said earnings money Fl, stated money loans Houston or other equivalent claims shot to popularity most better along with become the speak of area.

Such financing flat a way for some consumers to enter into the real estate land, and venture into industrial a house spending. However, soon, such funds proceeded a downhill.