- Certified phone accessories store

- 0616818330

- info@fulloriginal.nl

Unlock Family Equity Mortgage loan modification Treasures: Discover Unseen Potential

Distraire sur le craps avec avec l’argent effectif Les ecellents salle de jeu en compagnie de craps dans courbe du 2024

January 31, 2025BC.Game Casino Site Testimonial

January 31, 2025Family collateral mortgage loan modification software are created to help property owners exactly who are unable to make mortgage payments. Such applications could possibly offer multiple advantages, instance decreasing the interest, extending the mortgage title, or even flexible a portion of the debt.

Domestic collateral loan mod programs are becoming increasingly very important as more and more homeowners face financial hardship. New current economic downturn keeps contributed to an increase in foreclosure, and lots of people are searching for a method to end shedding their house. House security loan modification apps offer these types of homeowners having an effective lifeline, permitting them to remain in their homes and you can reconstruct the economic balance.

There are a number of various other household security loan mod apps available, for every using its very own unique qualification criteria and you may gurus. An informed system to possess a certain homeowner is based on their individual products. People that are given a house equity loan mod should talk to their bank for additional information on the brand new apps which might be readily available and also to know if they qualify.

Family security mortgage loan modification programs

Household guarantee loan modification software are created to let property owners who was unable to make their home loan repayments. These types of apps could possibly offer many advantages, including reducing the interest rate, extending the borrowed funds label, if you don’t forgiving area of the obligations. Understanding the different aspects ones apps is crucial for people trying advice.

- Qualifications: Determines just who qualifies to own loan modification apps.

- Pros: Lines the many benefits of mortgage loan modification, including shorter interest levels otherwise longer financing words.

- Process: Explains the strategies working in applying for and receiving that loan amendment.

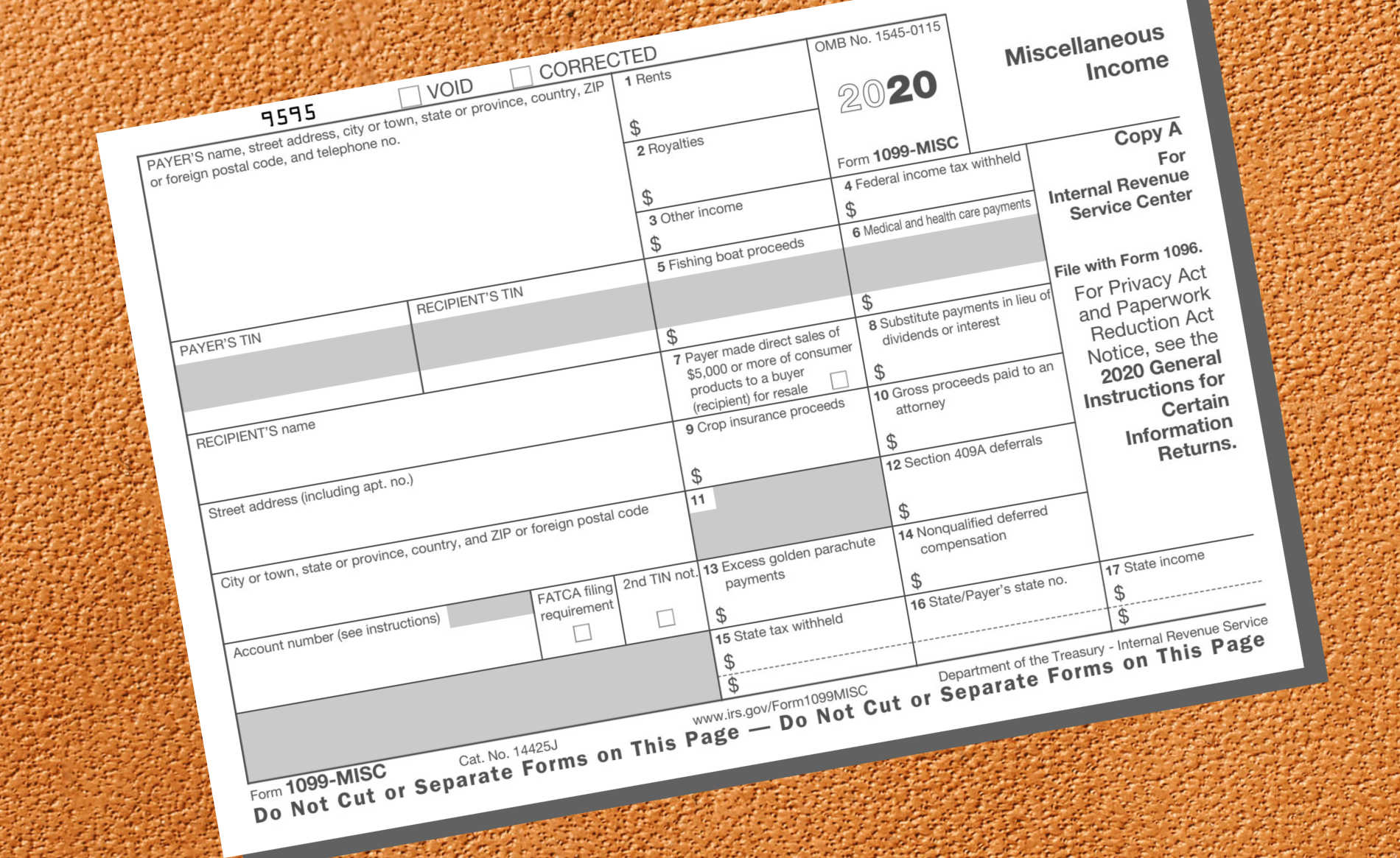

- Documentation: Listings the new data generally speaking necessary to assistance a loan amendment app.

- Options: Means the various brand of mortgage modifications readily available, particularly dominating prevention otherwise rate of interest protection.

- Affect Credit: Explains how loan mod can impact good homeowner’s credit history.

- Alternatives: Discusses other choices to possess people just who might not qualify for financing amendment.

- Timeline: Brings an overview of the typical schedule to own loan mod applications.

- Fees: Directories people costs in the loan modification.

- Achievement Prices: Provides data to your odds of financing amendment application getting accepted.

These key issues give an extensive knowledge of domestic security financing modification apps. By offered affairs such as eligibility requirements, possible advantages, together with software techniques, homeowners helps make informed choices on whether to realize mortgage loan modification because a means to fix the monetary challenges.

Eligibility

superior site for international students

Qualification is an important reason for determining exactly who qualifies for loan amendment programs. These applications are made to help residents up against pecuniary hardship, but they are unavailable to everyone. Loan providers has actually particular standards to assess an effective borrower’s qualification, and this typically tend to be items eg money, debt-to-money ratio, and also the cause for the brand new pecuniary hardship. Meeting these types of qualification conditions is essential to have homeowners trying to loan mod.

The necessity of eligibility can not be overstated. For people unable to generate mortgage repayments, loan modification software provide an excellent lifeline, taking chances to remove rates of interest, stretch mortgage terms, if you don’t forgive an element of the financial obligation. However, if the a citizen will not meet up with the eligibility criteria, they s that will face foreclosures.

Knowing the eligibility standards to possess mortgage loan modification applications is crucial having people facing financial pressures. By meticulously looking at their financial situation and you may seeing a homes therapist or financial, residents can be determine if they be eligible for these types of programs or take the required process to use.

Benefits

When considering family guarantee mortgage loan modification software, property owners should be aware of the potential benefits such software offer. Benefits associated with loan mod become reduced interest levels, offered loan terminology, plus mortgage forgiveness occasionally. These gurus can provide extreme economic relief so you can residents up against demands for making the mortgage repayments.