- Certified phone accessories store

- 0616818330

- info@fulloriginal.nl

Straight down interest rates makes funding home loans less expensive all over Wyoming

British Casinos casino Cobra login on the internet 2022 Full Set of Casinos on the internet from the British

December 11, 2024No-deposit Incentives to have Australian continent: Free Gambling enterprise Revolves & Cash on Register

December 11, 2024Property owners which may prefer to listing their houses have in all probability stopped doing this lately, as of numerous with an interest rate out-of cuatro% want to avoid to invest in an alternate financial at the seven%

SHERIDAN – All the way down rates of interest could help people across the condition qualify for lenders, however, reasonable mortgage loans are just one factor in easing a good property crisis during the Wyoming triggered primarily from the low have.

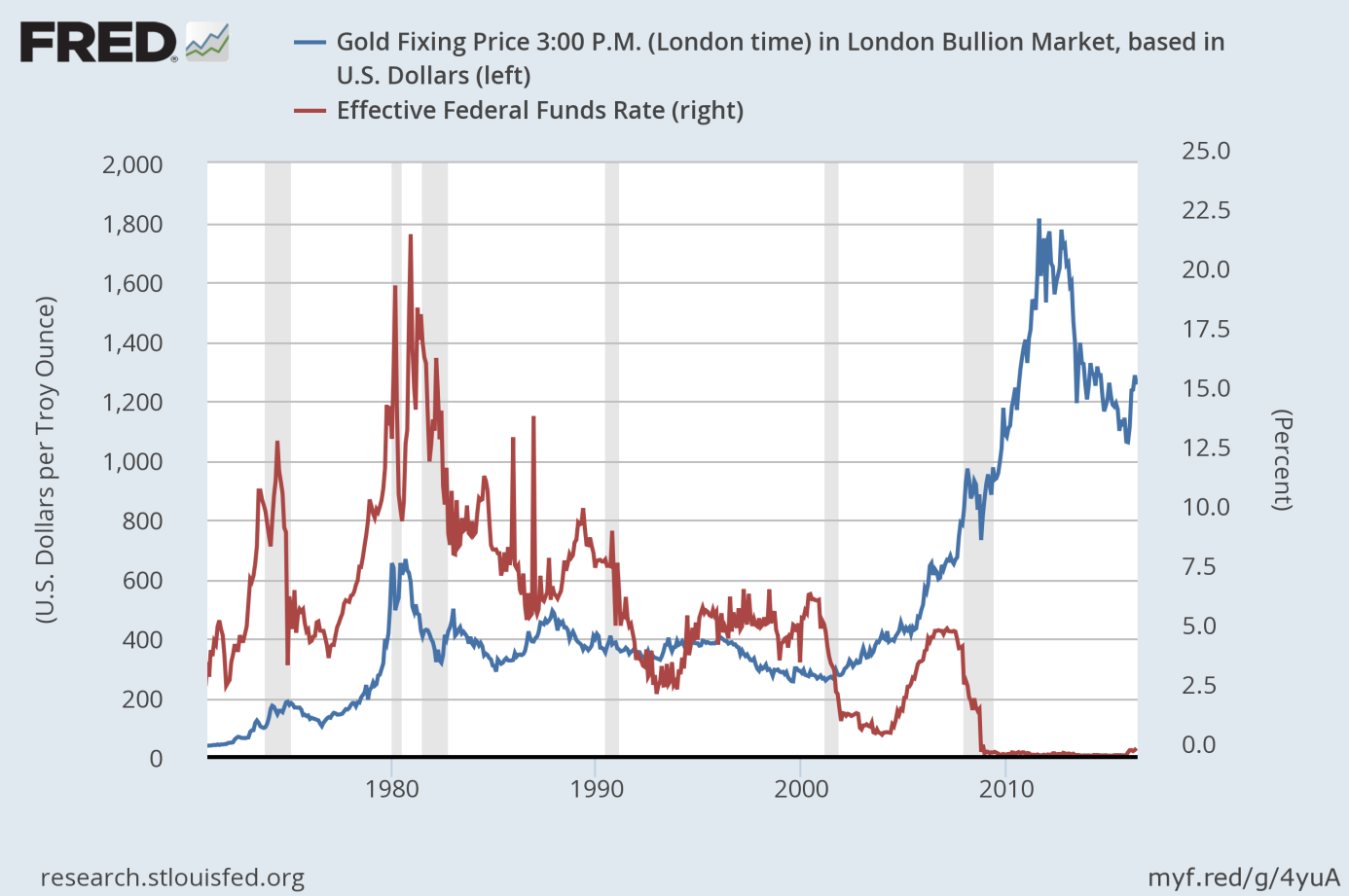

On the Sept. 18 , brand new Government Put aside launched it would down interest rates by the 1 / 2 of a share area, function the target variety to help you 4.75% to 5%. Interest levels into the mortgage loans started initially to fall even before the fresh new announcement.

Down borrowing costs for homebuyers, particular say, can lead to a surge during the customers that happen to be looking home. The all over the country homes drama could have been, into the highest part, motivated by the insufficient houses also have, and you may increasing the level of consumers in the business you are going to direct to a higher demand for a currently-restricted source of property.

, couch of Federal Set aside , demonstrated new disperse once the an effective “calibration” of your own central bank’s plan in lieu of a sign of issues regarding labor market’s health.

The instantaneous effect on home loan costs seems limited due to the fact locations had currently factored in the alteration, “being apparently constant following statement,”

. Some other interest is actually layered at the same time, based on the qualities of the borrower additionally the loan in itself, Godby told you. As the mortgages was enough time-identity duties, interest levels are considering 31-12 months treasury costs.

“It reduce support,” Godby said to your Wednesday. “To put it briefly that interest levels have previously fell to the mortgage loans, but they’re still relatively large.”

Since a week ago, a thirty-year fixed mediocre financial was six.1%, down out-of more seven% in-may for the seasons.

“This has currently fallen, additionally the reasoning this has fallen isnt since this particular rates clipped happened, however it is understood your Government Set aside commonly, barring particular biggest change in the fresh benefit, still clipped rates for a while. For folks who check their projections, they look for the enough time-term interest rates shedding,” Godby told me.

By 2026-2027, prices get slip by the forty%, definition mortgage loans will be within the higher cuatro% assortment, otherwise lower than 5%, as soon as the coming year. They may be less than 4% – but not much less than 4% – a year then, Godby told you, cautioning you to definitely their number was basically rates.

Short of with a depression which is very serious that rates of interest in the Government Set-aside go lower to no, home buyers does not get a hold of 2.8% otherwise step three.5% home loan prices again – which had been the pace almost a decade ago.

An educated individuals in the united kingdom will most likely safer an enthusiastic interest on the cuatro% variety, that’s usually regular, predicated on Godby. Generally, a 30-year financial will have mortgage loan of about a percent and a half over the Federal Set aside Rate: If it rate are 2.9%, the best financial speed perform fall-in new 4% assortment.

Homebuyers have reason to be hopeful starting 2025, since decreasing cost will help with cost, Volzke said. Property deals cost are still raised, though, and you may show others half brand new picture when calculating that last month-to-month homeloan payment.

The fresh Government Put aside set a “floor” toward rates for all categories of lending, off automobile financing to help you charge card loans in order to mortgages, considering College regarding Wyoming Affiliate Professor on the Economics Company

From inside the 2018, before the pandemic, the brand new statewide average housing price try more or less $228,000 . Today, the brand new statewide median house business price is nearer to $332,000 .

“So even with cost just starting to soften, the level of financial loans to be funded is actually a lot more highest than it was a couple of years back,” Volzke told you.

A decrease monthly installment loans for bad credit direct lenders Colorado in interest rates throughout the next year could help that have capital costs, but it also might have brand new “unintended effects” from delivering a whole lot more battle with the restricted casing stock in the Wyoming , Volzke told you.

“Far more aggressive pricing you may eliminate certain carry out-feel homeowners that have been sat on the subs bench due to observed higher cost back to our house browse class,” Volzke told you. “Up to a whole lot more construction list will likely be delivered to business, the brand new decreasing cost will help, however resolve, the new casing affordability difficulties we are experiencing.”

When creator fund has reached higher rates of interest, less companies are ready to use the chance to acquire since much to construct even more residential property, definition high interest rates have seen the effect out of reducing the amount of the brand new property on the market.

“No matter what of numerous land a builder would like to create, high interest rates create more difficult to accomplish this, due to the fact credit price of strengthening subdivisions becomes more burdensome. In the event it will cost you a whole lot more, they make smaller,” Godby said.

A second feeling higher interest rates have experienced with the likewise have out of house in the market from inside the Wyoming is something Godby entitled the newest “lock-in place.”

“The majority of people are getting place. One to ‘lock-into the effect’ has an extremely high impact on the production out of property available,” Godby told you. “The biggest the main marketplace is maybe not brand new house, but existing residential property.”

Metropolitan areas such as Jackson , Sheridan plus Laramie struggled which have value before the pandemic. Reducing conditions in those segments doesn’t invariably make it very easy to funds or get a property – it simply makes it reduced difficult, Godby told you.

“You could select the newest segments where, regardless of if rates of interest were extremely reduced, houses affordability had been a bona-fide difficulty. Those are extremely usually hotel groups, highest amenity organizations or communities one to feel highest progress,” Godby said. “Those architectural factors are particularly tough to resolve.”

Communities like this need to always incentivize affordable houses software aimed from the helping the local labor force buy a home, together with support builders willing to make sensible houses.

“Value is actually a bona fide complications here and there, and Jackson is actually definitely new poster youngster. That’s Sheridan and Laramie too,” Godby said. “You are will these are a need to really slow down the pricing out of homes having very important provider specialists including cops, fire, teachers, whom merely don’t create wages that may normally pay for property the way they could somewhere else from the state.

“In those activities, you have to speak about contributing to brand new casing stock because of unique programs, subsidies and earnings service,” he told you.