- Certified phone accessories store

- 0616818330

- info@fulloriginal.nl

Earliest Republic’s credit ratings had been move rubbish

2024’s Better Online slots Vegas World big win Gambling enterprises to experience for real Money

January 3, 2025Benefits and drawbacks from Tinder Wonders Admirer

January 3, 2025A slip in the offers of Earliest Republic Lender stumbled on halt towards organ Chase, Citigroup, and Wells Fargo was indeed ready to pump a mixed $29 million with the abruptly stressed lender.

Immediately after falling more 29% during the pre-business trade, Earliest Republic’s inventory started initially to stabilize on the reports off a potential help save and you may was right up more step 3% to help you $ inside midafternoon United states exchange. This new offers are nevertheless off nearly 74% from the beginning off March.

Brand new Ca-created complete-service bank and you will money government business’s destiny hangs in the balance following current failure of another mid-size of lender, Silicon Valley Financial (SVB), which designated the following-prominent lender inability during the United states record, and also the shutdowns of crypto loan providers Silvergate and Signature Financial.

SVB and you may Signature collapsed after depositors made withdrawal requests the banks could not meet. Including SVB, Earliest Republic’s customer base comes with rich subscribers and you may enterprises whoever places exceed this new endurance having government insurance policies. Towards the March a dozen, the financial institution established which acquired additional exchangeability out of JPMorgan and the Government Reserve.

To calm anxiety, government president go to this web-site Jim Herbert-just who depending the lending company inside 1985 and you can supported because the President until 2022-advised CNBC’s Jim Cramer towards the Mar. thirteen your lender was not seeing outsize outflows. Regardless of the reassurances, concerns you to definitely Very first Republic you certainly will feel a comparable run on dumps contributed S&P In the world Product reviews and you will Fitch Ratings so you’re able to clipped new bank’s evaluations so you’re able to e a day immediately after yet another ratings organization, Moody’s, placed Earliest Republic and you will half dozen most other banks under comment.

The latest San francisco bay area-mainly based, careful of a potential exchangeability crisis, has been investigating strategic selection, as well as a potential revenue, Bloomberg stated last night, sparking the brand new recent display speed shed.

First Republic Bank’s economic health, by digits

Throughout the 70%: Show of one’s bank’s places that will be uninsured as they surpass new $250,000 Government Put Insurance rates Company (FDIC) insured limitthe most depositors is recover if there is a good bank failure. It is above the median regarding 55% to have medium-measurements of banking institutions together with third-large from the classification shortly after Silicone Valley Financial and you may Trademark Lender, each of which in fact had 97% and you can ninety% uninsured deposits correspondingly.

61%: How much the brand new bank’s shares provides dropped in the last times while the worries abound that it’ll function as next domino to fall on burgeoning You financial drama

Over $70 mil: The fresh bank’s bare exchangeability-dollars it will use to respond to prospective client distributions-by way of the extra borrowing capacity about Government Set-aside, proceeded use of financing through the Federal Mortgage Financial, and you will capability to supply even more financial support as a result of JPMorgan Pursue & Co. which in turn increases, diversifies, and further improves Earliest Republic’s established exchangeability character, according to company. Even though 40% of your own bank’s depositors taken out, so it financing do protection they, claims Gary Alexander, monetary author during the Seeking to Alpha.

Have a tendency to Very first Republic Bank failure?

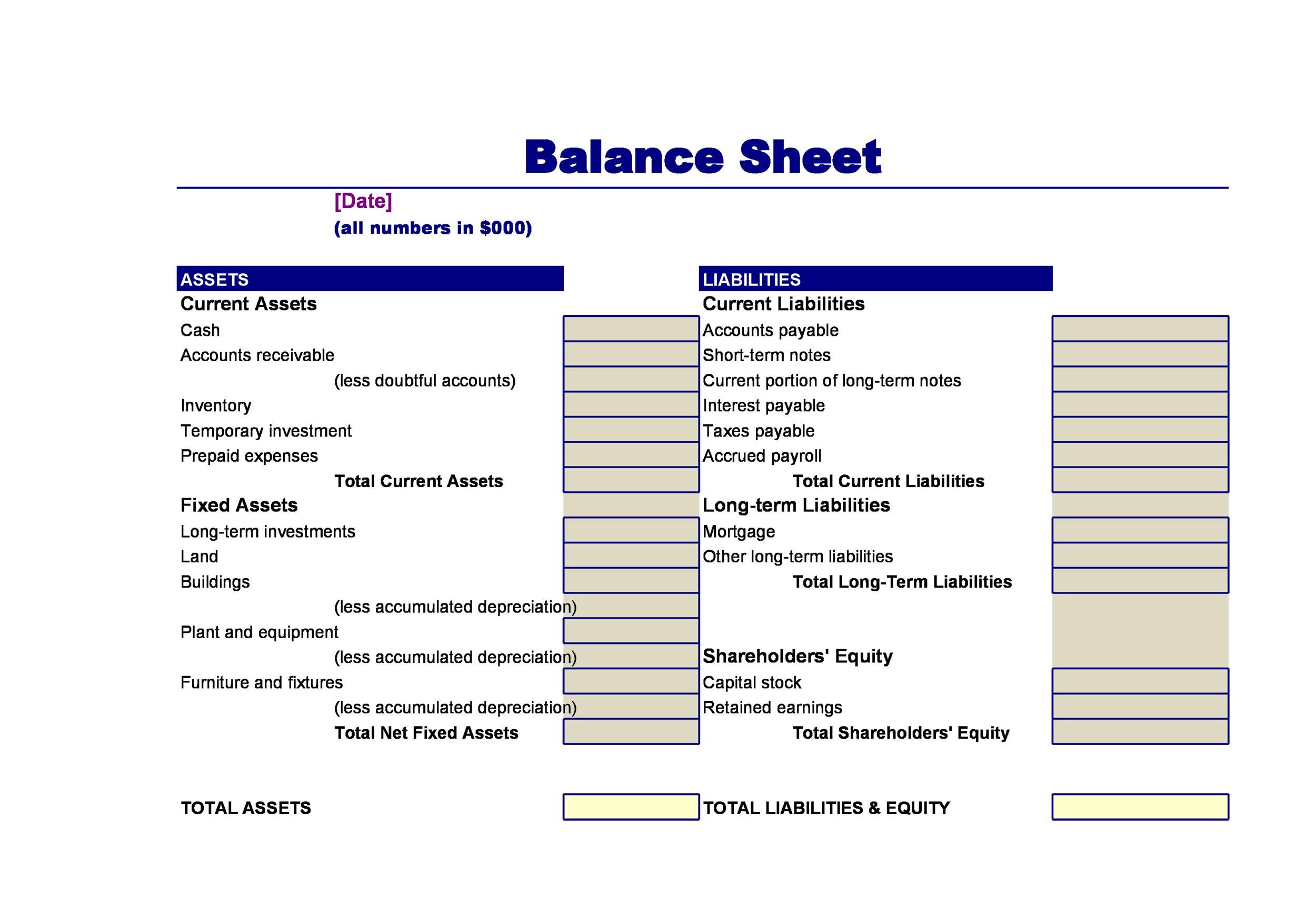

While Earliest Republic Lender and you may SVB was furthermore sized banking companies that have wealthy members, its equilibrium sheet sets share with completely different tales.

Very first Republic has actually more 2x the borrowed funds level of SVB, much less than a-quarter of their mortgage exposure, had written Seeking Alpha’s Alexander. Thus First Republic is more heavily adjusted towards stretched-period property which are not because the greatly exposed to brief-term interest rate risk and you can devaluations.

Quotable: United states treasury secretary Janet Yellen states the us banking system try sound

I am able to guarantees the people in new committee our banking program remains voice and that Americans can feel certain that the dumps is around once they you prefer all of them. Which week’s tips demonstrate the resolute commitment to make sure depositors’ coupons stay safe. Importantly, no taxpayer cash is used or put at risk with this action. -United states treasury secretary Janet Yellen’s waiting statements ahead of an excellent Senate Loans Committee reading now (Mar. 16).