- Certified phone accessories store

- 0616818330

- info@fulloriginal.nl

Citizen Equity Gains Input Protecting Cas Housing Segments

Laquelle se déroulent des placement dont abolissent réellement ?

January 24, 2025Alchymedes Slot Free Demonstration & Online game Comment Dec 2024

January 24, 2025As opposed to the nice Credit crunch, the latest quick intervention provided by new CARES Work made certain home loan forbearance alternatives for people have been financially damaged by new pandemic market meltdown and had a beneficial federally recognized loan. Even though forbearance options will assist certain homeowners remain their homes, the trail out-of a position rebound which is still uncertain could well be a significant determinant for some delinquency consequences. 1%, right up in one.2% recorded prior to the start of the newest pandemic.

The second analysis focuses on really serious delinquencies for the California since the condition is among epicenters of your foreclosure drama inside the great Recession and also the absolute matter remains on how the most recent crisis commonly change the nation’s casing , the newest major delinquency speed hit eleven.4% from inside the California, upwards out-of 0.3% inside the 2005 ahead of the start of this new property crisis. Inside the , severe delinquencies was in the 0.6% and have now reached step three.8% by the July.

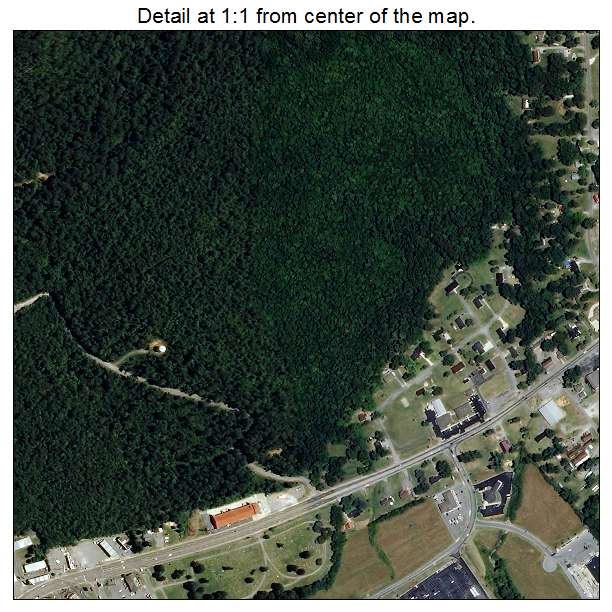

Since the really serious delinquency rate for the July continues to be just a great third of the https://cashadvancecompass.com/installment-loans-ia/oakland/ within the last recession, particular area areas regarding county have experienced a bigger improve during the delinquencies. Contour 1 depicts the fresh significant delinquency speed by the region inside compared in order to a year ago. Unfortuitously, some of the exact same areas you to definitely struggled in the previous foreclosures crisis try again watching elevated delinquency pricing, instance section throughout the Inland Empire and you can Main Valley, eg Bakersfield, Riverside and you will Stockton. Este Centro, and this advertised the highest delinquency rate, is a boundary town from inside the southeastern Ca towards the 2nd highest unemployment price in the united kingdom also ahead of the pandemic. For everyone advertised metros, severe delinquencies have raised about five-fold.

However, property owners facing delinquency in the modern recession have more choices than was available in the great Market meltdown. You to, listed above, ‘s the forbearance option. In the July, 8.6% from financing in the California was in fact within the forbearance just like the federal rates regarding 8.5%. The next option that current property owners features is the method of getting family equity that gives home owners with exchangeability needed seriously to end a good foreclosure in the event they experienced money losings from unemployment. Simply put, when faced with death of earnings and you may incapacity to invest a great mortgage, people which have family equity can invariably opt to promote their home and steer clear of a foreclosures.

Across the country, major delinquencies (mortgages ninety+ those times owed or in foreclosure) in July reached cuatro

Average homeowners’ guarantee inside California on the 2nd quarter off 2020 is actually more $400,000, compared to the You.S. mediocre out of $185,000.

But, nearly 40% of them whom plumped for an excellent forbearance proceeded and then make repayments to their mortgage loans hence perhaps not getting delinquent on the finance

And even though not absolutely all property owners has guarantee, the newest CoreLogic Household Equity Declaration found that at mid-12 months the percent away from mortgaged home with negative guarantee from inside the California had refuted to just one.7%, the lowest while the Great Recession and only a portion of the newest underwater’ peak away from 37.3% at the conclusion of 2009.

Shape dos illustrates average resident collateral across the Ca area parts. Obviously, higher San francisco metros best record that have average guarantee ranging from $600,000 to help you $one million, in the event some of the almost every other nations within the Southern California and you can Central Shore nevertheless hover up to $five hundred,000. On the reverse side, areas having increased delinquencies have observed slow price growth more the final 10 years and hence more sluggish accumulation out-of collateral, although mediocre collateral along the Main Area and you may Inland Empire continues to be about $100,000.

Today, when you’re home prices possess essentially fell during earlier in the day recessions ultimately causing people to shed equity, houses rules certain to the present market meltdown have contributed to an acceleration out of family speed increases . And you may according to the CoreLogic Household Price Forecast, home prices when you look at the Ca are required to keep the fresh new yearly boost and you can expand in the 4% into the (Profile step 3). Nonetheless, most of California’s rates development would-be driven by the coastal parts, instance Bay area and San diego, but according to CoreLogic Markets Exposure Indicator, precisely the Modesto area urban area provides higher risk (65% or higher) away from seeing an amount refuse as a result of next August.