- Certified phone accessories store

- 0616818330

- info@fulloriginal.nl

Do you really get home financing within the Canada having less than perfect credit?

Caesars Harbors: Play 100 percent free Ports 1M Free Coins

January 10, 2025Subscribe United kingdom Local casino Pub & Wake up so you can £700 inside Greeting Incentives!

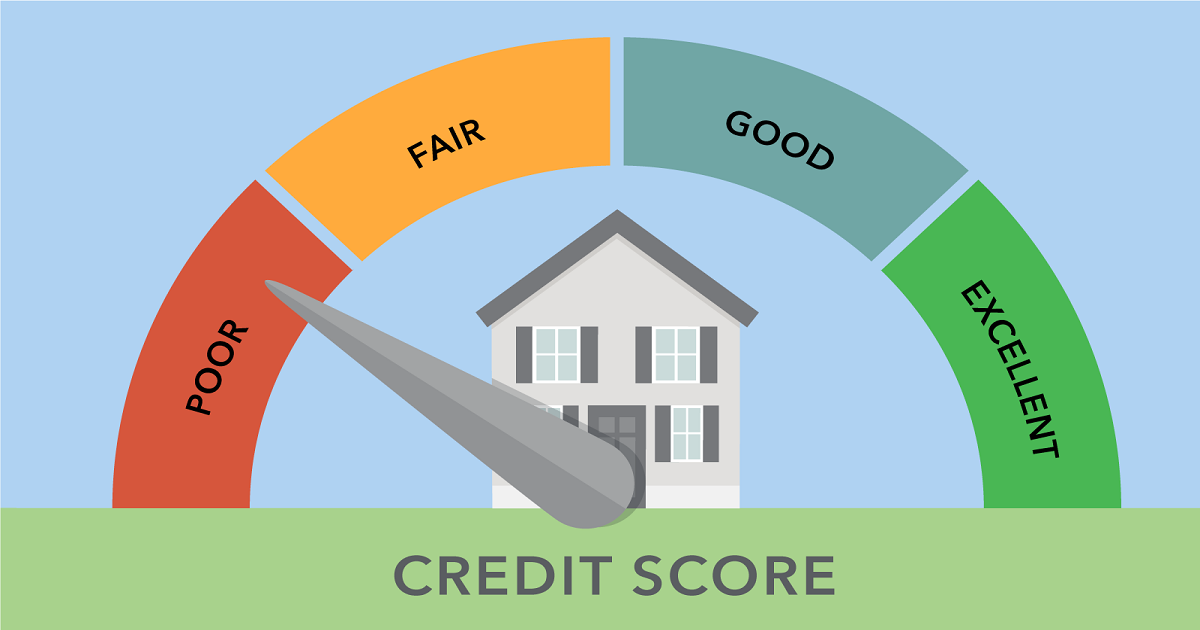

January 10, 2025Your credit score can have a negative or a positive effect into each other your ability so you’re able to be eligible for their financial and words you are offered. The reason is that your credit rating find exactly how at stake youre having defaulting on your own financial.

There are increased credit history and stay seen as a low risk if the credit history means that you are doing n’t have numerous financial obligation and you create regular money. You will find a lower credit rating, and therefore get noticed once the a top exposure because of the lenders, when you yourself have a lot of debt as they are later to your using the expense.

Loan providers such finance companies don’t want to provide much of money to a borrower which they deem getting unlikely to repay the mortgage. In the event that, centered on your credit score, a lender really does deem you a danger of defaulting, you’re going to have to shell out a much higher rate of interest through the living of the mortgage so you’re able to echo you to definitely quantity of risk. For folks who pay highest interest levels, your home loan repayments could well be more costly and it surely will charge you alot more cash in the long term.

Yes. Old-fashioned mortgages within the Canada normally include a good 20% down payment requirements and do not need Canada Mortgage and you will Housing Agency (CMHC) insurance policies. As a result you can find reduced limits to the factors for example minimal credit score standards additionally the guidelines are determined of the for each bank. There are even first-day family client applications available in Canada that can help you.

In other words, possible get approved to possess a home loan which have an excellent credit rating as low as 600. Yet not, exactly how many loan providers that ready to accept your residence financing might be narrow the lower the score.

Options to score a home loan having bad credit

For those who have less than perfect credit and then have problem securing home financing regarding a much bigger lending company for example a major bank, searching to believe businesses and you may borrowing unions otherwise subprime and personal loan providers. If you find yourself deemed a risky borrower otherwise, these types of financial institutions are usually expected to assist your. Either way, yet not, for individuals who get home financing with a poor credit score, you will be more inclined to expend a notably large rate of interest.

- Including good co-signer

- Considering a combined home loan

- Saving additional money being build a larger off commission

How can i improve my personal credit rating?

For people who manage your credit responsibly, you are going to increase your credit history. How can you control your borrowing from the bank significantly more sensibly? Listed below are about three info:

- Establish credit score

- Pay their expenses punctually

- Restrict the fresh credit needs

Let’s look closer at each ones techniques for enhancing your credit score so you enter a beneficial most readily useful status should you make an application for you to home loan:

You can present your credit report by getting a charge card and using they for issues that you’d buy anyhow, including market. If you are being unsure of what it is, you have access to and determine your credit history by getting an my response effective credit history using a card bureau. You can request a free credit history on a yearly basis out-of TransUnion and Equifax and it surely will not apply to your credit rating. You may make the consult sometimes on line or as a consequence of cellular telephone or email address.

To keep up an effective cost history also to replace your borrowing from the bank rating, try to shell out your bills punctually and also in completely. If you are unable to pay the bill completely, it is essential to no less than try to meet with the lowest payment. If you believe you will see issue expenses your expenses, you can always contact your financial.