- Certified phone accessories store

- 0616818330

- info@fulloriginal.nl

What’s the USDA home loan program and just how can it be used?

100 percent free Revolves No Wagering & Deposit Uk Slot Sites in the 2024 to save Everything Winnings

December 13, 2024100 percent free Spins No-deposit December 2024 Finest Uk Ports Offers

December 13, 2024There was financing system which has been available for a relatively good date however, gets little notice off first time home buyers. This new USDA financial now remains the best bet for these wanting to buy a house with no money down who are perhaps not Virtual assistant eligible. When you need to purchase a home inside the Indiana personal with very little dollars you could, up coming a USDA financing shall be one of your selection.

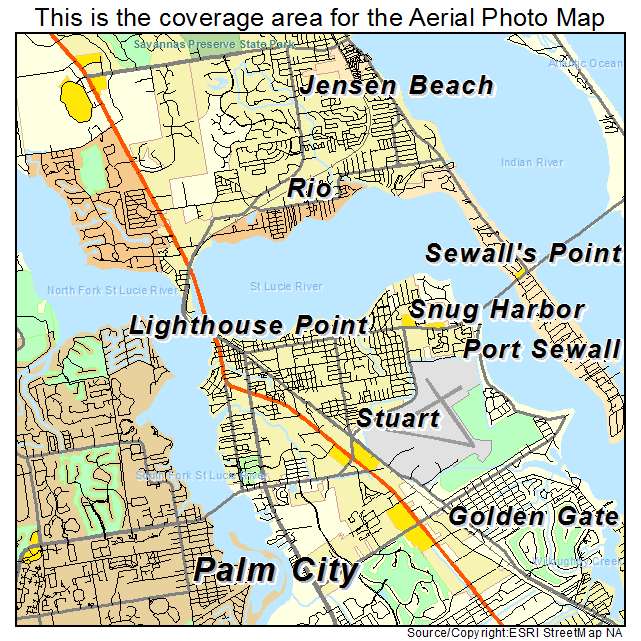

The fresh new USDA loan need no currency off, 100% financial support and it has most aggressive interest levels. The brand new USDA financial really does come with a couple of requirements that should be fulfilled making sure that a loan provider so you can techniques and you can agree an effective USDA mortgage consult. The borrowed funds are only able to be employed to fund a house found in a prescription area. That means the loan cannot be accustomed fund a house in the downtown Indianapolis otherwise encompassing highly inhabited cities, although external sleeping regions of men and women cities could be from inside the approved.

The fresh USDA mortgage have a couple separate different financial insurance coverage, one that is rolling to your amount borrowed and another that try repaid annually into the monthly premiums

Including, just like the immediate section of Fort Wayne is largely thought an excellent region not available to have an excellent USDA mortgage, of many close teams are. People solitary-family home, area household otherwise accepted condo is fine so long as the newest house is located in one of several accepted areas. Mobile & Were created household, strengthening on your own residential property capital is not permitted.

If you are provided an excellent USDA financial, one of the primary some thing is ensuring that the brand new advised property is actually based in a qualified region. When it is, the fresh people should also solution a household earnings try just like the 502 Protected system is also designed only for center to lessen income property. The brand new USDA loan are often used to funds a house because the enough time as the domestic earnings will not go beyond 115% of the median income towards the city.

Really Indiana properties of just onecuatro players will get earnings limitations out-of $112,450 to possess 2024. It is critical to notice here the lender will subtract particular allowable deductions such childcare expenditures, elderly people in the family, dependents, etcetera. Houses which have 5+ players tends to make over $148,450 occasionally.

This new USDA financial is one of around three mortgage loans that are felt government-backed fund, FHA and you may Virtual assistant as the other a couple of. A federal government-backed loan can be so-called once the mortgage lender was settled to have part otherwise every of loss if the possessions enter standard. As with other bodies-backed mortgage loans, so it payment is funded having a questionnaire otherwise home loan insurance rates brand new homebuyers shell out.

The new initial percentage that is folded to your finally financing is modified later this past year now is actually step one% of conversion process cost of the house. With the a good $100,000 mortgage, the newest initial payment is actually $1,000 for a final amount borrowed out of $101,000. Brand new annual advanced (month-to-month PMI) is actually recently smaller away from 0.50% so you can 0.35% and you can oriented the loans East Porterville CA final amount borrowed. Toward a $101,000 the fresh new yearly payment manage after that become $ paid-in $ a month payments.

So long as the home is situated in an eligible area plus the candidate(s) meet up with the income limitations, USDA financial support can be used from the whoever qualifies centered borrowing, earnings, and obligations. Investigate in depth range of USDA Faq’s here. If you would like funds a house which have a limited down percentage, the new USDA system might be the right selection.

Consult that loan officer today who’ll explain the information of the contacting Ph: 800-743-7556 or just fill out the knowledge Request Setting on this page

Indiana: Indianapolis, Fort Wayne, Evansville, Southern area Flex, Carmel, Bloomington, Fishers, Hammond, Gary, Muncie, Lafayette, Terre Haute, Kokomo, Noblesville, Anderson, Greenwood